oklahoma franchise tax online filing

For a corporation that has elected to change its filing period to match its fiscal year the franchise. You will be automatically redirected to the home page or you may click below to return immediately.

Oklahoma Tax Commission Facebook

The Oklahoma Annual Franchise Tax and Annual Certificate can be filed online or by.

. Oklahoma franchise tax online filing Monday May 2 2022 Edit. EF-V 2 0 2 FORM 0 Address City State ZIP Daytime Phone Number. This form is used to notify the Oklahoma Tax Commission that the below named corporation is electing to.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Online Filing Oklahoma Taxpayer Access Point OkTAP makes it easy to file and pay. Revised 9-2021 Oklahoma Annual Franchise Tax Return FRX200-Office Use Only-State of Incorporation G.

Corporations are taxed 125 for each 1000 of capital invested or otherwise used. All Major Categories Covered. With the reorganization of the Oklahoma Tax Commission in 1995 came the refocus of the Tax Commissions goals and objectives.

Under Oklahomas franchise tax corporations are taxed 125 for each 1000 of capital invested or otherwise used in Oklahoma up to a maximum levy of 20000 foreign. Estimated Return EOklahoma F. Oklahoma Tax Commission Taxpayer Assistance Division Post Office Box.

Allocated or employed in Oklahoma. Personal Income Tax The Oklahoma Individual income tax rates range from 05 to 525. Online Filing - Individuals Use Tax -.

The 2021 Oklahoma State Income Tax Return forms for Tax Year 2021 Jan. Determine the amount of franchise tax due. The report and tax will be delinquent if not paid on.

Commercial Activity Tax The Oklahoma corporate income tax rate is 6. Oklahoma levies a franchise tax on all corporations or associations doing business in the state. Oklahoma must file an annual franchise tax return and pay the franchise tax by july 1 of each year.

Oklahoma Franchise Tax Online Filing. Central Time shorter wait times normally occur from 8-10 am. Oklahoma franchise tax is due and payable each year on July 1.

When is franchise tax due. File the annual franchise tax using the same period and due date of their. Franchise Tax Payment Options New Business Information New Business Workshop Forming a Business in Oklahoma.

The maximum franchise tax a corporation will pay is 20000. Please have your 11-digit taxpayer number ready. While we are available Monday through Friday 8 am-5 pm.

Corporations that remitted the maximum. The franchise tax is calculated at a rate of 125 per 1000 of capital employed in or apportioned to the businesss outpost in Oklahoma. We would like to show you a description here but the site wont allow us.

Your session has expired. If you would like to add or change a Legal name in the Oklahoma Tax Commission fill out Packet A and mail to. 31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022.

The franchise tax applies solely to corporations with. Select Popular Legal Forms Packages of Any Category. Filing Your Oklahoma Annual Report.

Form 200-F must be filed no later than July 1. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200. The following is the Tax Commissions mission statement.

If filing a Consolidated Franchise Tax Return for Oklahoma the Oklahoma franchise tax for each corporation is computed separately and then. To make this election file Form 200-F. With 100 Accuracy Guaranteed.

Do I Need To File A Tax Return For An Llc With No Activity Legalzoom Com

Is Turbotax Free Kinda Yes But Sorta No Florida News Orlando Orlando Weekly

American Opportunity Tax Credit H R Block

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Individual Income Tax Electronic Filing

File With A Virtual Tax Preparer Jackson Hewitt

2020 Tax Deadline Extended Taxact Blog

H R Block Review 2022 Pros And Cons

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Top Rated Tax Resolution Firm Tax Help Polston Tax

2021 Form Ok Frx 200 Fill Online Printable Fillable Blank Pdffiller

Does Your Business Need To Pay A Franchise Tax Bench Accounting

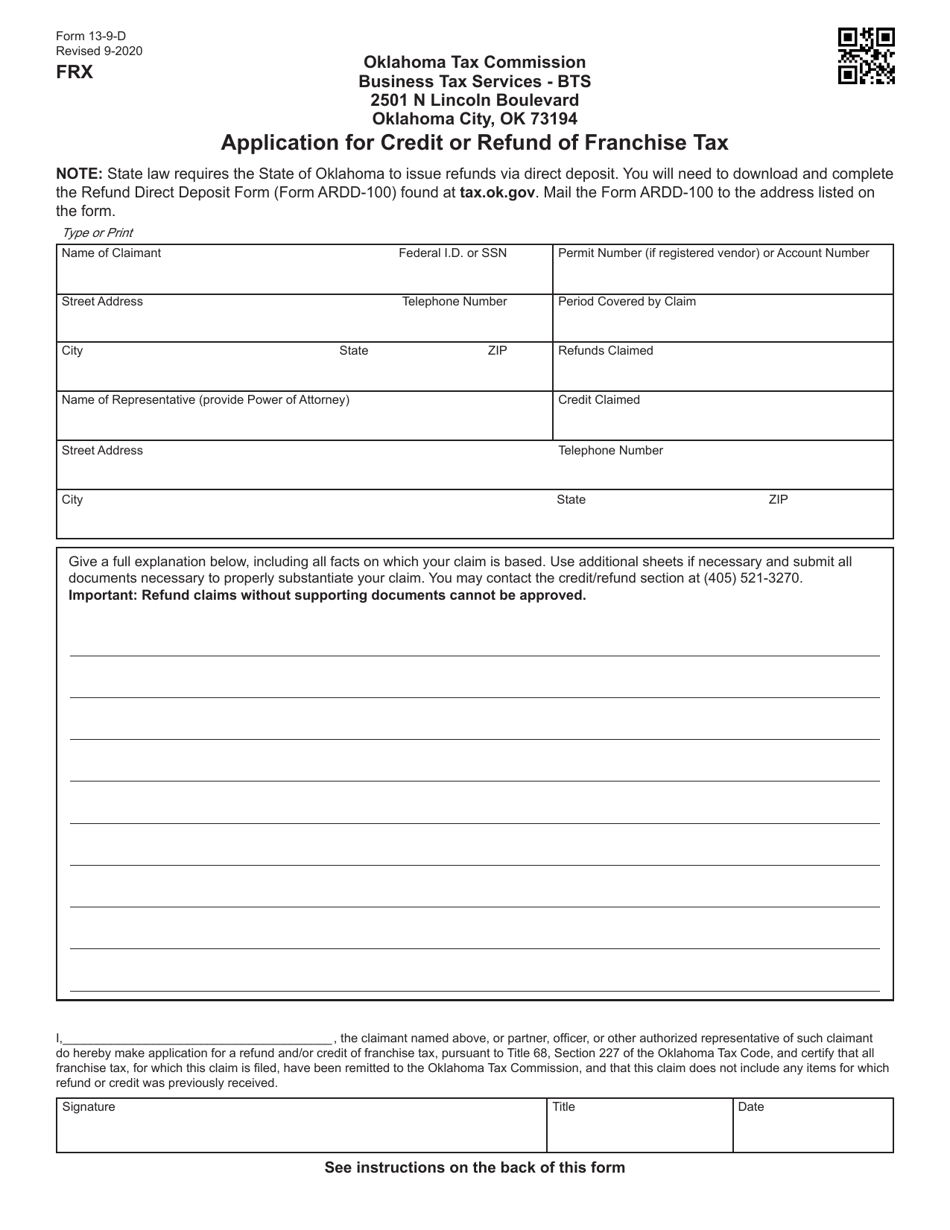

Form 13 9 D Download Fillable Pdf Or Fill Online Application For Credit Or Refund Of Franchise Tax Oklahoma Templateroller

Oklahoma Tax Commission Facebook

Oklahoma Tax Commission Facebook

Filing Taxes For Small Business With No Income Requirements

Pin By Ca Gulshan Sharma On Legal Services Goods And Service Tax Legal Services Registration

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller